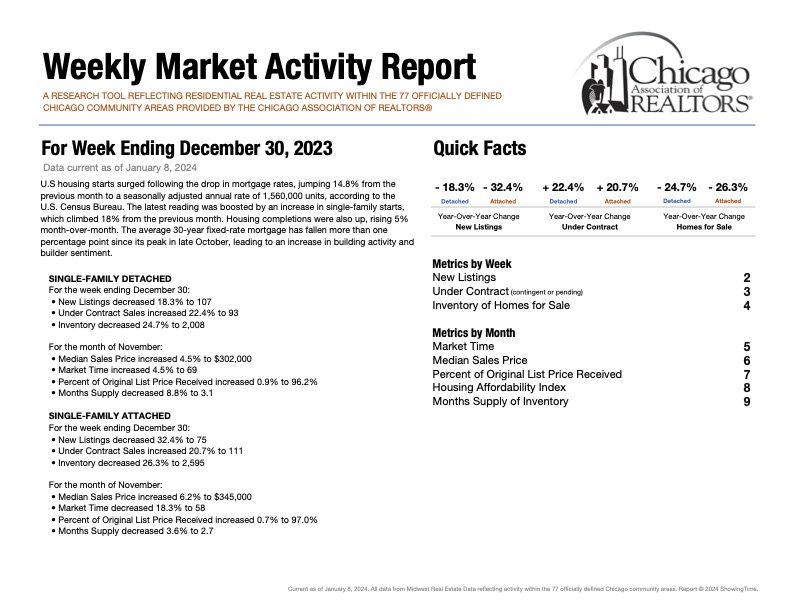

Weekly Statistics

See full report here for the ending of May 5th 2018

Data current as of September 17, 2018

Changing demographics, income levels, corporate growth and natural disasters all affect

residential real estate markets. Home prices in Seattle and San Francisco have increased

amidst e-commerce and technology success stories, while listings and sales decline

precipitously when a hurricane strikes. This week, we are reminded of the destruction

delivered by Hurricane Harvey to Houston at this time last year. From Katrina to Sandy to

Maria to Florence, housing markets have bent but remain unbroken.

Source: CAR

See the full report here for the ending of February 17th, 2018

The trends from the last several weeks and, honestly, the last several months remain in place in much of the country as well as locally. The market is trying to sustain a healthy number of listings to keep pace with a consumer base that is clearly in a buying mood. There is real evidence of increased showing activity and anecdotal evidence from busy real estate professionals that we are setting up for another busy year in residential real estate.

Source: CAR

See the full report here for the ending of January 18th, 2017

“At the beginning of a calendar year, it is often common for home buyers and sellers to become immediately more active. Call it the result of a resolution or the promise of something new, but it is a noted phenomenon across the country. It’s really too early to say if the trend will continue in 2018, but the first weeks of the year have not necessarily shown a huge jolt in activity so much as the last weeks of 2017 were quieter than usual.”

Source: CAR

See the full report here for the ending of December 9th, 2017

“National economic trends can help inform what the housing market will do over the next

year. Residential real estate should remain active if joblessness continues to decline and

wage growth picks up. However, those increased wages must be in line with median sales

price increases. Unfortunately, that has not always been the case. Add in factors such as

increasing mortgage rates, student loan debt and lower affordability, and the balance

becomes more interesting but not insurmountable for home purchasers.”

Source: CAR

See the full report here for the ending of December 2nd, 2017

“As the year works its way to a closing crescendo, it is evident that the year’s predominant storyline is beyond a clever weekly jab. It has been an interesting and remarkably positive year for residential real estate. Even as some desirable housing tax breaks are on the verge of sunsetting, real estate, as a whole, remains in great shape.”

Source: CAR

See the full report here for the ending of November 25th, 2017

“From week to week, the tallies may vary slightly from the week prior in year-over-year comparisons, whether with a strong positive surge or a lingering negative streak. Tracking weekly figures is important for active real estate professionals, but the cooldown period of a meaningful real estate trend often takes weeks, if not months, to draw determined conclusions.”

Source: CAR

See the full report here for the ending of November 18th, 2017

“Home price appreciation is on the rise in most of the country, which is welcome news for any homeowner that experienced a time when it was not. Although trends vary by region and state, the overarching trend is increased prices, according to research performed by the National Association of REALTORS® on American Community Survey data from 2005 through 2016. Price growth is strongest in the South and less so in the Northeast, and only a few states show no growth or losses. This includes Illinois, unfortunately, though the outlook has improved greatly in recent years.”

Source: CAR

See the full report here for the ending of October 28th, 2017

“The national unemployment rate registered in at 4.1 percent for October 2017. To put that in perspective, joblessness has not been this low in the U.S. since December 2000. In other positive economic news, mortgage rates have been holding steady at or near 3.9 percent. Historically, the average rate has been around 6.0 percent. Factors such as these keep the pool of potential buyers full, even during the so-called off-season of residential real estate sales.”

Source: CAR

Berkshire Hathaway HomeServices KoenigRubloff Realty Group

1800 N. Clybourn Ave.

Chicago, IL 60614

312-388-4594

© BHH Affiliates, LLC. An independently operated subsidiary of HomeServices of America, Inc., a Berkshire Hathaway affiliate, and a franchisee of BHH Affiliates, LLC. Berkshire Hathaway HomeServices and the Berkshire Hathaway HomeServices symbol are registered service marks of HomeServices of America, Inc. ® Equal Housing Opportunity.

Nancy Hearon 312-953-5076

Janet Fitzpatrick 312-388-4594